90% of startups fail. This is a bitter truth that is hard to digest, and we are not saying this; Forbes claimed it in one of their articles. But where is the problem? It could be anything from advertiser’s strategies that don’t work to the lack of proper market research, inadequate funding, or poor idea execution. But what if you have enough funding and a great idea? Even then, it doesn’t guarantee the desired results, especially if your business falls under the dating and adult category.

Due to legal regulations and social norms, advertising dating and adult products through roadside banners or pamphlets is not allowed. These businesses need digital platforms that attract the right audience. However, digital advertising for these products can be tough because of strict rules, limited reach, and a lot of competition.

Many ad networks place a ‘No Entry’ sign on these categories, and some publishers do not allow these types of online ads on their websites; 7SearchPPC finds innovative ways to help dating and adult businesses reach their target audience effectively.

This case study will provide insights that could be valuable if you’re running a dating or adult business and looking to promote it successfully.

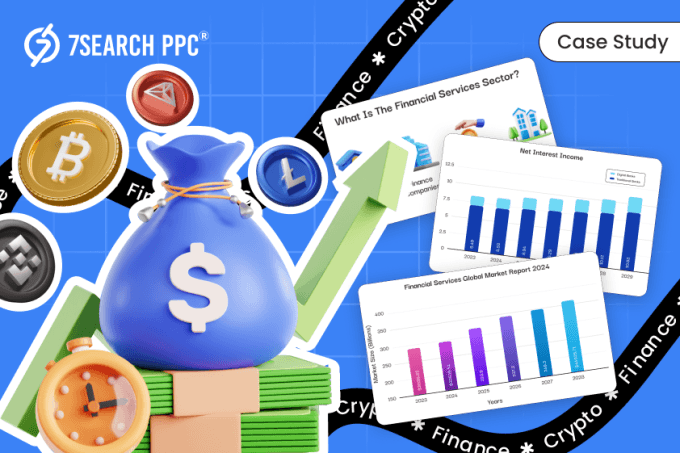

The Size and Growth of the Online Dating Market

The online dating business creates apps or websites where people can connect for relationships, friendships, or casual chats. These platforms use profiles and matching tools to help users find the right match. They make money through subscriptions, ads, or paid chat rooms. Online dating businesses are categorized into various forms:

- General Dating

- Niche Dating

- Match Making

- Adult Dating

If we talk about market growth, we bet that the size and growth of the online dating industry are beyond what you might expect. We were also shocked when we reviewed the data and couldn’t believe our eyes at the immense potential of this market.

- The Online Dating market is projected to generate US$3.05 billion in revenue in 2024. From 2024 to 2029, the market is forecast to grow at an annual rate of 2.48%, reaching US$3.45 billion by 2029.

- The Online Dating market is expected to have 462.5 million users by 2029. In 2024, about 5.0% of people are expected to use online dating, and this is projected to increase to 5.7% by 2029.

- The average revenue per user, or in short, ARPU, is expected to be US$7.80. Globally, the United States will generate the most revenue, with US$1.39 billion expected in 2024.

(Data Source- Statista)

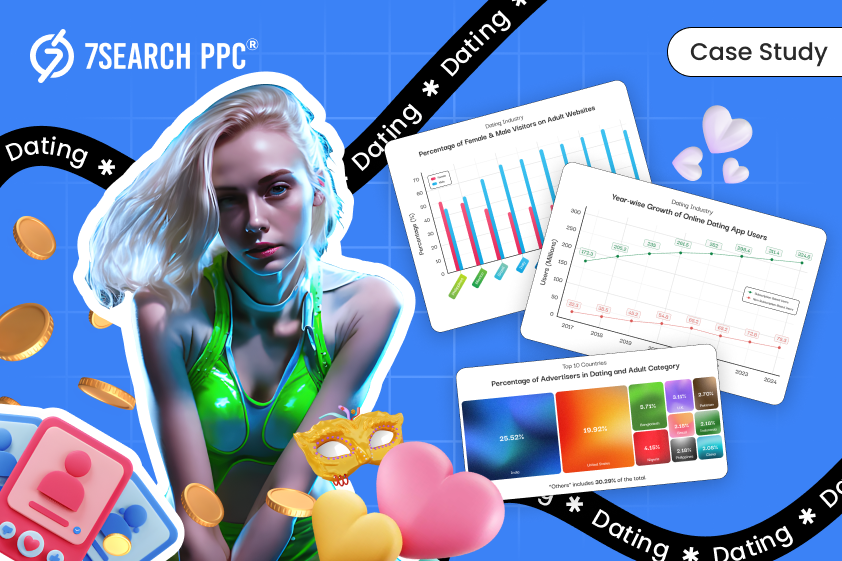

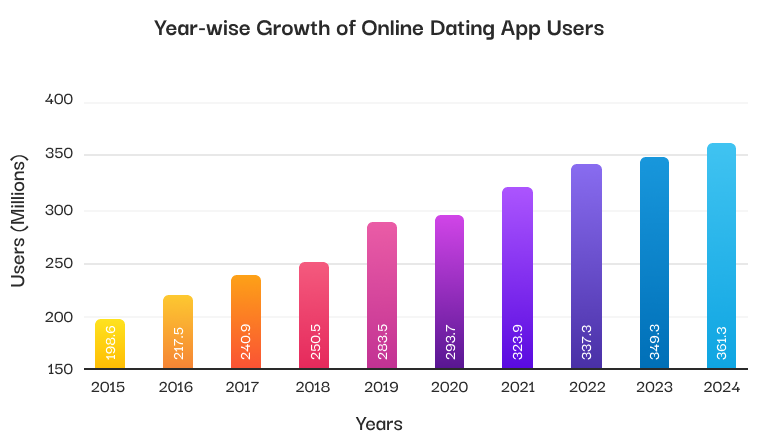

Year-Wise Growth of Online Dating Apps Users

Digitalization plays an important role in increasing the usage of online dating apps, including adult dating. As people gain more knowledge about these dating apps, user enrollment also increases every year.

As shown in the bar graph, in 2015, the number of dating app users was only 198.6 million, and now it is expected to reach 361.3 million by the end of 2024.

Above, you can see the growth of users (in millions) who use online dating apps year by year.

The dating business model is clear-cut. It mainly focuses on attracting customers who want to fill the empty space in their lives by making the right match or looking for a partner who can satisfy their naughty desires.

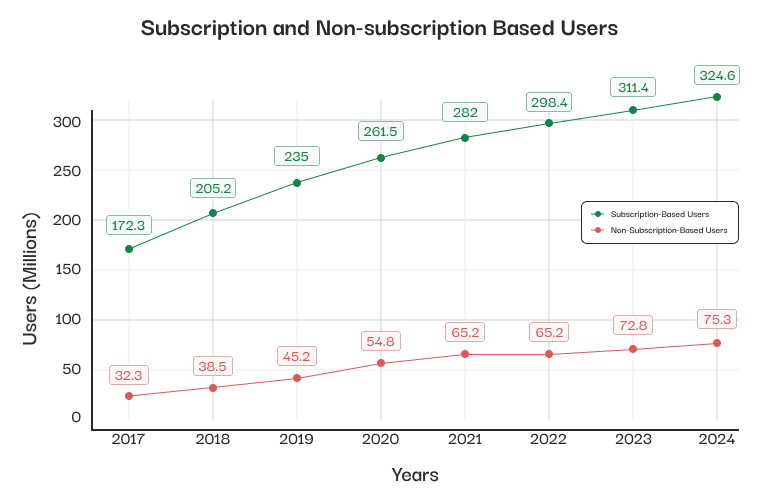

These companies provide two choices: a subscription-based model and a non-subscription-based model.

- Subscription-Based: In this model, companies take a subscription fee to access all the dating platform’s features for a specific period. This includes unlimited messaging, profile visibility, and other premium services for adults.

- Non-Subscription Based: In this model, dating businesses hide many options, and some features are available only for a limited time.

In the figure below, two lines are displayed: one represents the growth of users using subscription-based dating apps, while the other shows the growth of users using non-subscription-based dating apps.

The True Scale of the Adult Market

It all starts with a secret desire. Desire creates wants, wants creates demand, demand creates supply, and if all goes the right way, growth becomes possible. The adult market is different from other industries. Here, people can’t openly watch or use adult products and services, but most importantly, they are used for sure, which is why the market size continues to grow every year.

The adult entertainment market has witnessed magnificent growth recently. It is expected to increase from $60.62 billion in 2023 to $65.95 billion in 2024, growing at a rate of 8.8% per year.

According to a report by The Business Research Company, the adult market is projected to continue expanding in the coming years, reaching $93.23 billion by 2028, with an annual growth rate (AGR) of 9%.

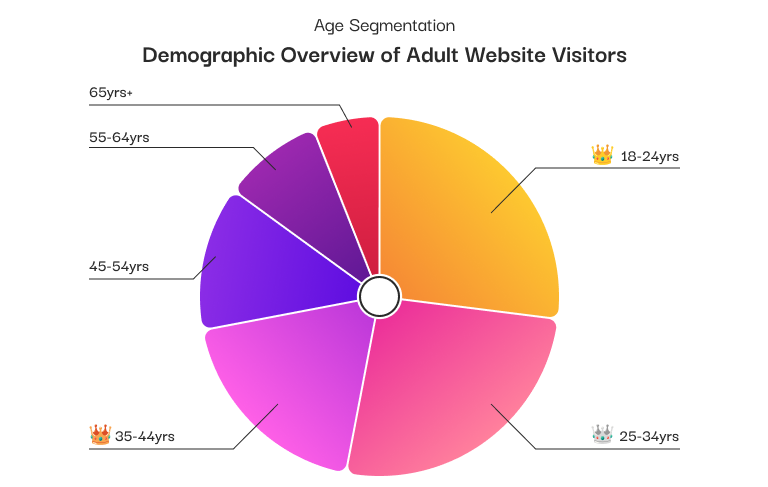

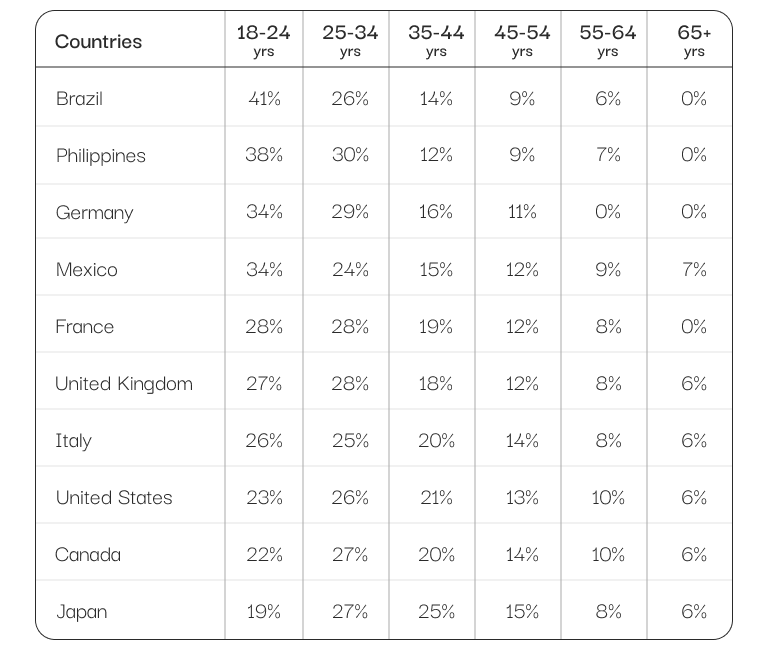

Age Segmentation of Adult Website Visitor Traffic

This demographic analysis of visitors by age provides valuable and informative insights for advertisers targeting specific age groups for adult advertising. We have researched different age groups and their behavior, which are given below (Please note that this age group includes a mix of males and females.)

- 18-24 Years:

- Percentage: Around 27% of visitors.

- Behavior: This age group tends to be the most active internet users, with a higher inclination towards exploring various types of adult products and services.

- 25-34 Years:

- Percentage: Around 26% of visitors.

- Behavior: This age group is often highly engaged and typically spends more time on adult websites. It also includes recently married couples who may want to spice things up by purchasing kinky products.

- 35-44 Years:

- Percentage: Around 19% of visitors.

- Behavior: People in this group typically look for more specialized content on adult websites. They are usually more financially stable, which means they may spend more on premium or paid content.

- 45-54 Years:

- Percentage: Around 13% of visitors.

- Behavior: This group might prefer more specific or traditional content. Since they usually have more time to browse, they may check out a wider range of adult websites.

- 55-64 Years:

- Percentage: Around 9 % of visitors.

- Behavior: People in this group may visit adult websites less often, but they usually search for specific content. Many in this group visit these sites to reconnect with intimacy, especially after life changes like divorce or retirement.

- 65+ Years

- Percentage: Around 6% of visitors.

- Behavior: Visitors in this group are less frequent but may seek content related to intimacy and personal connections.

Countries with the Most Visits to Adult Websites

Countries with the most visits to adult websites tend to vary depending on the data sources and the metrics used (e.g., overall traffic, per capita visits, etc.). However, we’ve tried our best to find the countries that consistently rank high regarding adult website traffic. Below, you can see the traffic divided by different age groups, along with the corresponding percentages.

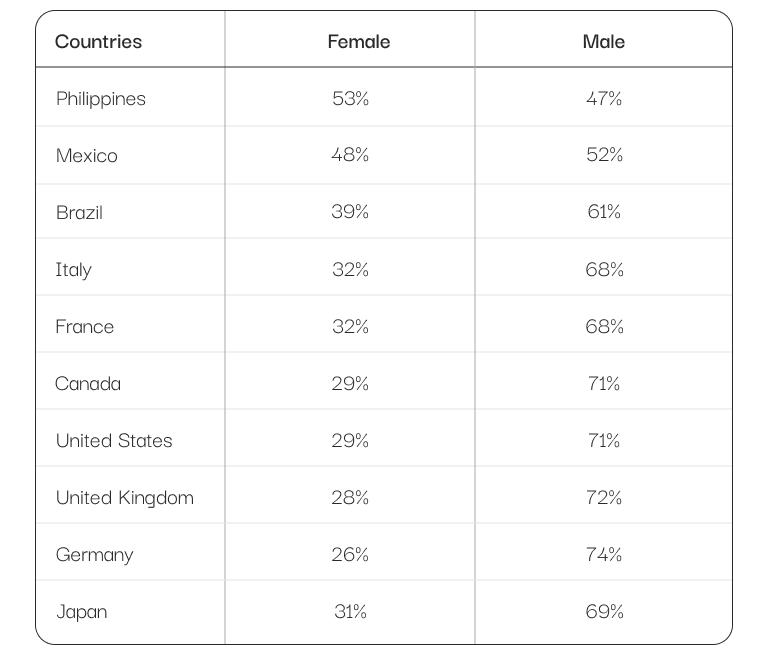

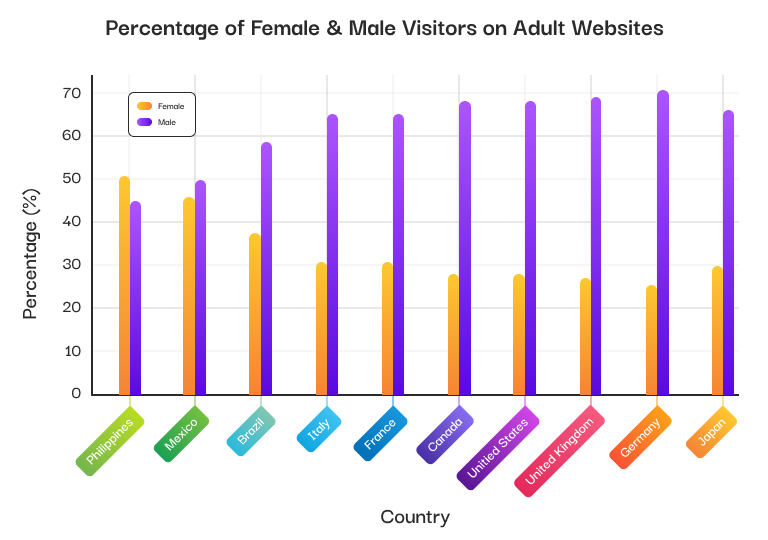

Gender Proportion of Adult Website Visitors

Some adult products and services are not suitable for all genders, as they are designed for specific needs and preferences. For advertisers, it is essential to understand the gender distribution of visitors on adult websites (country-wise) to enhance their ad campaign strategies. Below, you can see the proportion of adult website visitors by gender.

Navigating Advertising Challenges in Dating and Adult Businesses

Adult advertisers face several challenges due to industry rules, restrictions, and the nature of their content. To better understand these issues, we decided to investigate further and identify additional problems faced by advertisers.

We compiled a list of advertisers running ad campaigns in the dating and adult category at 7SearchPPC and sent them a set of random questions. As a result, we identified some common problems. (The problems they mentioned were the ones they faced before joining our ad network):

Ad Platform Restrictions

Many mainstream digital advertising platforms, like G****e, have strict policies against advertising adult content. This limits the ability of adult advertisers to use these ad platforms to promote their adult offerings effectively. This limitation blocks their path to success and forces them to depend only on specialized adult ad networks, which might not have the same reach, targeting options, or ad costs.

Mr. George (Advertiser at 7SearchPPC): I felt like I was doing something illegal because many major ad platforms banned my adult ads.

Stigma and Negative Perception

Advertisers in the adult industry often face a negative social stigma, which can affect their total earnings. Publishers put themselves out, and they never allowed such adult content on their websites because it can harm their reputation and they might lose their earned audience.

Miss Kerry Peterson (Advertiser at 7SearchPPC): Well, the challenges are numerous in the adult industry, but the main one I’ve encountered is the need for an ad network that matches my adult ads with adult websites and blogs.

Compliance with Regulations

Different countries and regions have diverse regulations regarding adult content. Advertisers must ensure they are compliant with local advertising rules and laws, which can be complex and constantly changing.

Mr. Robert (Advertiser at 7SearchPPC): Dealing with different rules in each region is tough for me because it’s hard to keep up with constantly changing laws.

Limited Targeting Options

With many restrictions on adult content across most advertising platforms, advertisers have limited options for precise audience targeting. This can lead to less effective ad campaigns, as advertisers may not be able to reach where they get the maximum visibility on their adult ad campaigns.

Mr. George Kent (Advertiser at 7SearchPPC): I chose an ad network to promote my adult products, but I was disappointed when I saw the limited targeting options available. I think this was the major problem at that time.

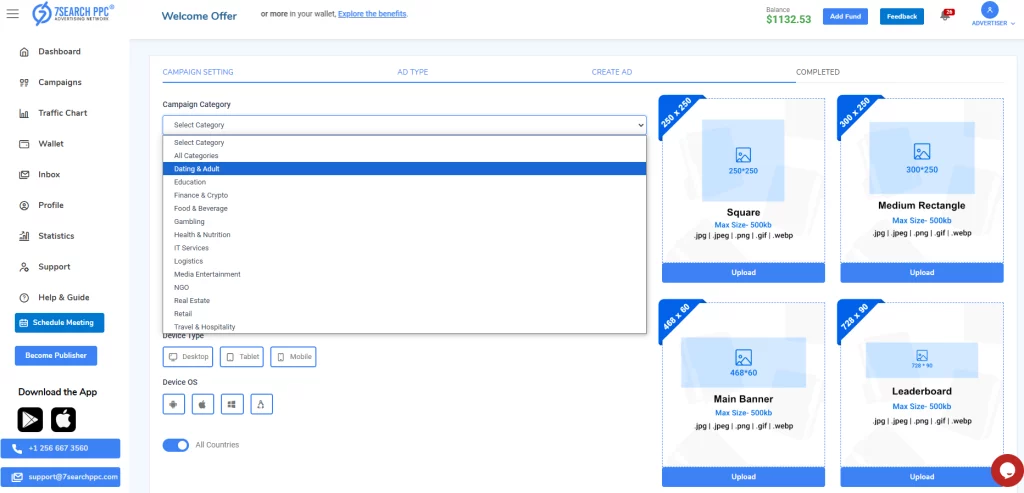

Merging ‘Dating’ with the ‘Adult’ Category: A Bold Move by 7SearchPPC

If you are using 7SearchPPC to promote your dating or adult business, you might be aware of the merger between these two categories. If you’re a new visitor looking to promote your adult or dating products and services, don’t be confused. Now, when creating your ad campaign, you will find the “Dating and Adult” category under the Campaign Category option.

Why have we merged both categories?

At the start of 2023, we set several ambitious goals for our ad network, 7SearchPPC, and one of them was to deliver the best results to our adult and dating advertisers. After holding many meetings, analyzing data, and consulting experts, we decided to merge these two categories for the following reasons:

The Search Intent of the Audience Is the Same

As we all know, the dating and adult categories attract similar kinds of audiences who are seeking intimate or personal connections. This overlap in search intent allows us to target the same group of users with relevant PPC ads, making it easier to optimize ad campaigns and increase engagement. By merging both categories, advertisers can now better address the needs of users looking for personal or romantic experiences.

We Can Use Publishers for Both Categories

Merging the dating and adult categories allows us to use the same publishers for both types of content. This is a smart move because publishers who focus on one category can now show ads from both. This increases the number of ads they can allow on their websites. As a result, our ad network becomes more efficient and smoother for both advertisers and publishers, which helps improve ad performance.

Delivery of Higher-Quality Traffic

Quality traffic matters and we are dedicated to providing it to our respected advertisers. By combining both categories, they can now attract more quality traffic. Users looking for dating or adult-related content are likely to interact with ads in both categories, which allows us to provide good traffic. As a result of this move, advertisers are getting more leads than before at 7SearchPPC.

Publishers Can Get Better Monetization Opportunities

We believe in a balanced approach, where we not only bring opportunities to advertisers but also offer amazing benefits to publishers. With a merged category, publishers can earn more by promoting ads from both the dating and adult sectors. This combination opens up more opportunities for monetization, as they can run ads across a larger audience base and benefit from a wider range of advertisers.

The result? A daily increase in the publishers’ earnings graph at 7SearchPPC.

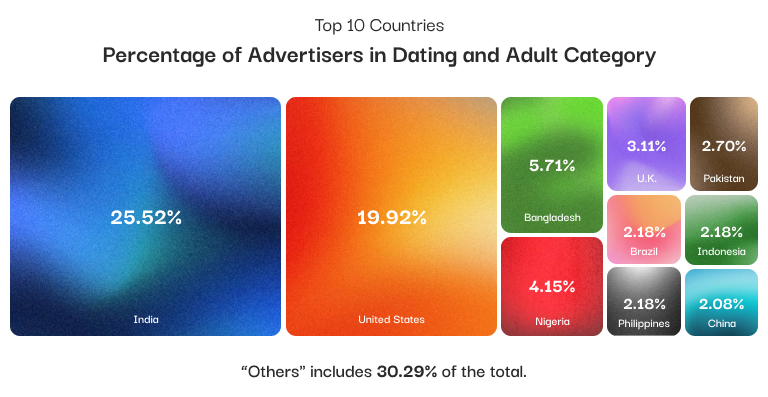

Top Countries with Most Dating & Adult Advertisers on 7SearchPPC

Our ad network has made its mark in various countries, starting in India. Today, advertisers from all corners of the world, especially those in the dating and adult categories, are talking about us. Assured success is our USP, and advertisers are gradually experiencing it.

Around 91% of advertisers who created their ad campaigns in the dating and adult categories found our platform through organic search. This percentage is a testament to our success—when clients actively search for your name on search engines, it speaks volumes about the reputation you’ve built.

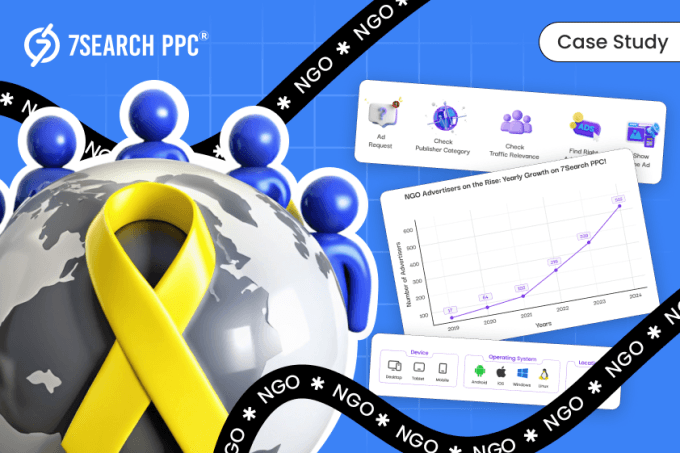

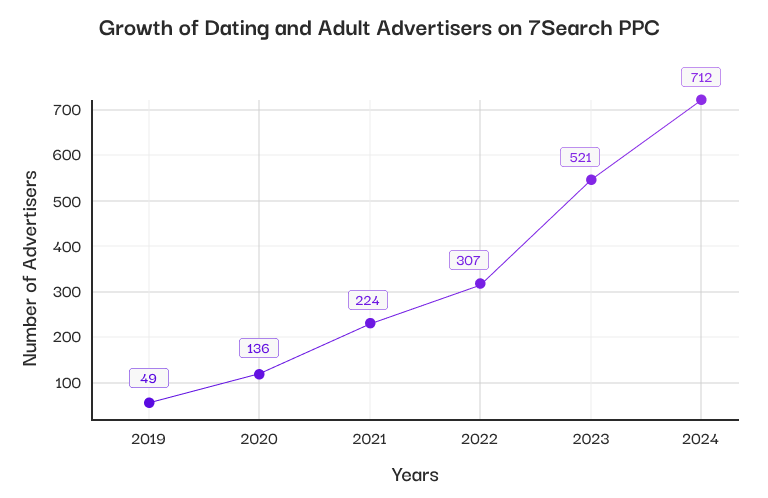

Year-by-Year Growth of Dating and Adult Advertisers

We are proud to have earned the trust of advertisers in the dating and adult categories. Since 2019, the number of advertisers on our platform has grown from 49 to an impressive 712* in 2024. This growth is because, from the start, we have focused on providing high-quality traffic, strong targeting features, and a safe environment for dating and adult ads.

We understand the specific advertising needs of this niche and welcome advertisers looking to overcome the barriers imposed by many ad networks. Our continuous focus on delivering results has made us a trusted choice for advertisers looking to grow in this competitive space.

(*Year 2024 is about to end, and we are fully confident that we will touch the figure of 800.)

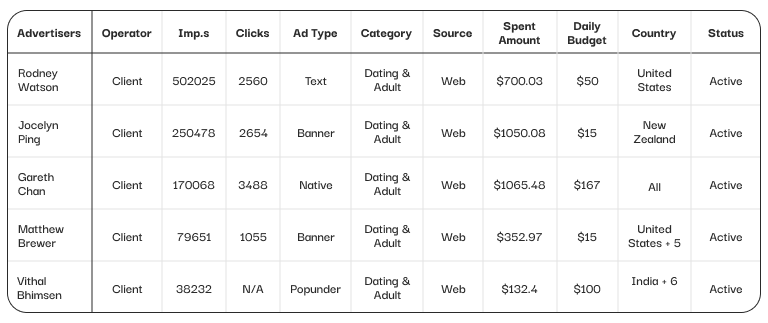

Best-Performing Campaigns in the Dating and Adult Category

We understand that you’re eager to learn more about the outcomes of our success. At the core of our achievements lies the success of our clients. When they are satisfied with our advertising services, we consider it a significant accomplishment. With most of our clients expressing satisfaction with our ad network, our team recently decided to analyze the top-performing campaigns within the dating and adult category. Here’s what we found.

In the above table, you can see that the top five high-performing campaigns are running under the dating and adult category on 7SearchPPC. Our client, Mr. Rodney Watson, has received the most impressions and has spent $700.03 so far. The runner-up, Mr. Jocelyn Ping, has received 250,478 impressions and spent $1,050.08, which is more than Mr. Watson’s.

From this, we can infer that while upgrading the budget is important, the most crucial factors are your targeting strategy and choosing the right ad format for your dating and adult ad campaign.

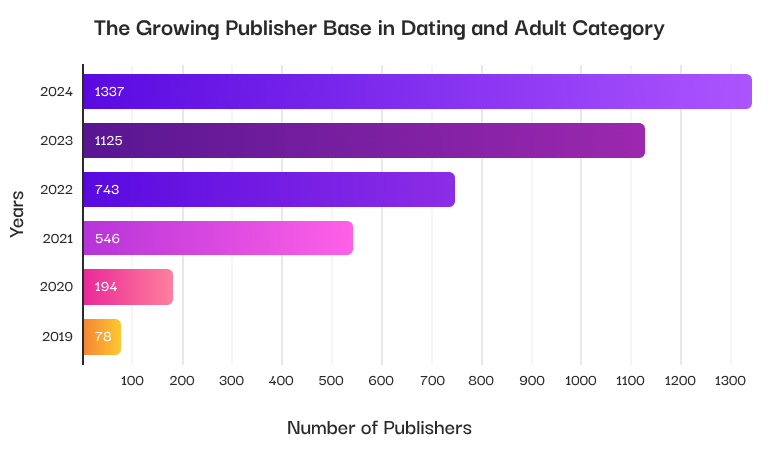

The Growing Publisher Base in Dating and Adult Category on 7SearchPPC

Numbers that speak louder than voices:

|

Years |

Number of Publishers |

| 2019 | 78 |

| 2020 | 194 |

| 2021 | 546 |

| 2022 | 743 |

| 2023 | 1125 |

| 2024 |

1337* |

(*The publishers’ data in the above table was collected at the end of November; the number might increase by the end of 2024.)

When we first entered the world of ad networks, we were new to it, and, to be honest, we didn’t fully understand the value of publishers. However, as time went on, we began attracting advertisers from various verticals, which helped us realize the true importance of publishers.

As you see in the above table, in the dating and adult vertical, we started with just 78 publishers. Now, as we approach the end of 2024, that number has grown significantly to 4,023 publishers.

Country-Wise Impressions in Dating and Adult Category on 7SearchPPC

|

Countries |

Impressions |

| INDIA | 114473047 |

| UNITED STATES | 51458768 |

| NEPAL | 28707845 |

| GERMANY | 12665598 |

| PAKISTAN | 9387606 |

| BANGLADESH | 8790660 |

| SINGAPORE | 8583135 |

| HUNGARY | 7305469 |

| CAMBODIA | 7300019 |

| BRAZIL |

6877798 |

The data shows that 7SearchPPC has a strong reach in different countries within the Dating and Adult category. With many impressions across various global markets, our platform gives advertisers the chance to connect with a wide and active audience.

Ad Format Preferences Among Dating and Adult Advertisers

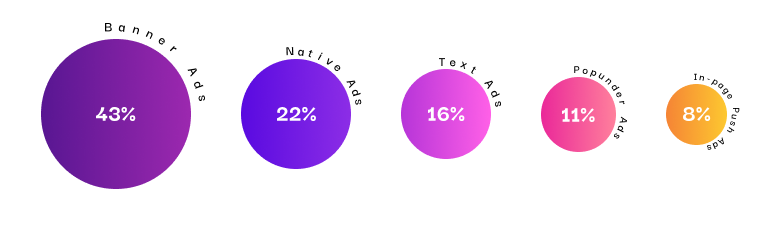

On 7SearchPPC, dating and adult advertisers are using a mix of creative ad formats to engage their audiences. The most popular choice is Banner ads, with 43% of advertisers opting for them.

Native ads come next, making up 22%, while Text ads account for 16%. Popunder ads are used by 11%, and In-page push ads are selected by 8%. This variety of options allows advertisers to choose the best format that fits their campaign goals and helps them connect with their audience in the most effective way.

Final Outcomes?

- The online dating and adult markets are experiencing significant growth, with a growing number of users and revenue.

- Due to societal norms and regulations, traditional advertising methods are limited for these industries and are no longer effective.

- Many digital advertising networks restrict adult and dating content, which makes it difficult for dating and adult advertisers to reach the target audience.

- 7SearchPPC offers a specialized platform to help businesses in the dating and adult industries overcome advertising challenges and reach their target audience effectively.

- Understanding the age demographics of the target audience is crucial for dating and adult advertisers.

- 7SearchPPC addresses common challenges faced by advertisers in dating and adult industries, such as platform restrictions, stigma, regulatory compliance, and limited targeting options.

Ending Note

7SearchPPC has effectively solved the common problems faced by advertisers in the dating and adult industries, such as strict regulations and negative perceptions. Our ad network has provided an innovative solution by offering targeted, high-quality traffic and ensuring compliance with regional advertising laws.

Through its approach, 7SearchPPC has not only enhanced ad performance but also created valuable monetization opportunities for publishers. Our efforts to provide amazing results to our beloved clients will never stop at any cost because our goal is big, and our commitment is even bigger.