The travel industry has been booming again ever since its severe plummet during the COVID-19 pandemic. The number of US residents traveling overseas, which once dropped by 80% in 2020, rose by 85% the following year. (By: Statista)

For travelers, it’s time to wind back and enjoy themselves after a stressful year. For advertisers, though, the story is a bit different. Business is back to normal (and even better), so they can’t complain.

However, with this comes the struggle of staying on par with a good number of competitors. Half of them shut down in the first few months, while others struggle for a long time. To cope, many turn to PPC travel advertising via ad networks.

7Search PPC, our self-serve ad platform, has guided a number of travel businesses to their goals. From delivering your travel ads to analyzing data, you get the best of all worlds here.

With this case study, allow us to tell you the story and statistics of how we helped travel businesses find conversions, traffic, and, ultimately, success.

The State of The Travel Industry Today

Before we tell you how 7Search PPC helped travel businesses, let’s first understand the state of the travel industry we are faced with today. Through extensive research, we have identified many areas where travel advertising can flourish.

According to reports by Statista:

- The travel and tourism market as a whole is projected to reach a revenue of US $916.00 billion in the year 2024.

- It is further estimated to grow annually at a rate of 3.99%, resulting in a market volume of US $1,114 billion by 2029.

- Online sales are expected to account for 75% of the total revenue of the travel and tourism market by 2029.

Another report by McKinsey highlighted the following trends in favor of the future of travel.

- 75% of travel spending is projected to be domestic. With the United States currently taking the lead, China is close behind and about to overtake it in the coming years.

- New markets such as Eastern Europe, India, and Southeast Asia are emerging sources of outbound tourism. Indians’ annual travel spending is projected to grow by 9%, while Southeast Asia and Eastern Europe are around 7%.

- Unexpected destinations like Rwanda are trying to lure in travelers and establish themselves alongside others.

These statistics are self-explanatory as to why the travel industry is so lucrative and competitive.

With constant expansion, there’s always a need for new and existing businesses to serve. Focusing your travel advertising within these imminent sectors can be a great option to reach new people.

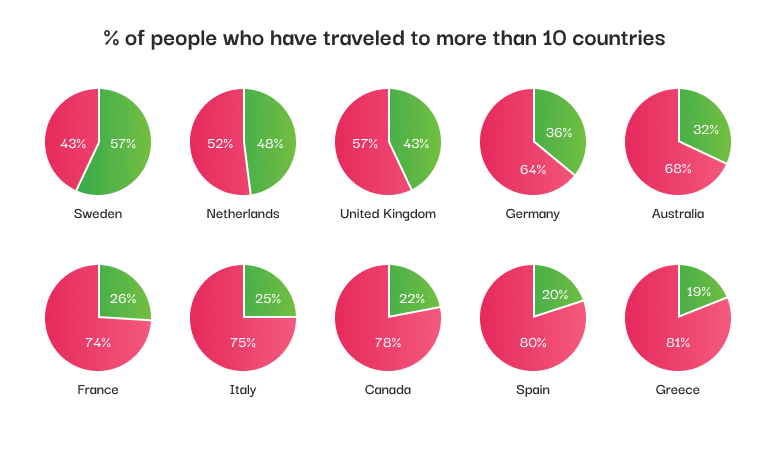

To further add to this, we have compiled a list of countries whose citizens have traveled the most. This is based on a survey conducted by the Pew Research Center in 2023.

(% of people who have traveled to more than 10 countries outside their own)

Our advertisers saw immense growth and conversions once they started targeting their travel ads in these countries. People who travel the most are always on the lookout for new and better services that can cater to them. They are more open to exploring, which proposes a great opportunity for travel businesses.

How Travel Advertising Looks Like

The year 2020 was when travel advertising took the most hit in the United States.

Luckily enough, the segment caught up with the losses the next year, with the ad spending starting to near pre-Covid levels.

- According to reports by Dentsu, travel advertising is expected to grow by 5.5% in 2025.

- As per reports by eMarketer, US travel media network ad spending is expected to increase to $2.96 billion in 2026.

Not only does this signify an increasing opportunity in travel advertising, but also increasing levels of competition.

Tackling the Challenges with 7Search PPC

When we first started helping travel businesses advertise, one thing was clear for us: we had to make them stand out. But the big question was ‘How?’ What do our advertisers want? What would their target audience need? How can we combine them both to ensure the optimum delivery of ads?

One question led to another, and we finally ended up asking fellow travel business advertisers their thoughts. After all, isn’t that who we are going to serve and satisfy? After some questions and hundreds of conversations, here is a summary of the challenges that we found.

1) The Challenge: Competitive Market and Bids

More than half of our advertisers complained about the competitive market, which automatically led to higher bids for a single ad space.

Mr. Louie Howard, advertiser at 7Search PPC, said, ‘Since travel is a rising industry, competition knows no bounds. This becomes a problem when I have to bid higher than what my budget allows me to.’

The Solution: Affordable Bids

7Search PPC offers affordable bids through which you can buy traffic at reasonable prices. You can either manually set the bid or choose the automated one, which will inform you about the current top bids and minimum bids.

When you target all countries with your travel ads, the minimum bid amount for the CPM model needs to be $0.0001, and for the CPC model, it needs to be $0.1.

2) The Challenge: Scattered Consumer Attention

Many advertisers said that consumer attention lies mostly with the big travel agencies, agents, and other providers.

One of our advertisers, Kate Sykes, said, ‘It’s tough to become trustworthy and differentiate my business from others.’

The Solution: Multiple Ad Formats

We recommended Kate and other advertisers facing the same issue to experiment with our multiple ad formats. Travelers are often convinced by:

- Native ads that don’t disrupt their experience blend in with other travel content.

- Banner ads that allow you to visually present destination and service pictures, effectively catching the attention of interested audiences.

7Search PPC also offers a variety of other ad formats, including Text, Popunder, and In-page Push ads. Video ads are also currently underway.

3) The Challenge: Exceeding the Budget

Some advertisers implied that since they are required to run multiple campaigns for various destinations and services, switching from one to another would always exceed their budget.

As our advertiser, Mr Shakir Abdul, pointed out, the task was time-consuming and required careful budget distribution, which often led him to lose money pointlessly.

The Solution: Limiting Budget Spend

To prevent advertisers from exceeding their budget, 7Search PPC offers a feature where they can set their daily maximum budget spending limits, further which your campaign will turn off for the day.

*Note: Your daily budget limit needs to be at least $15.

4) The Challenge: Lack of enough data

Many advertisers also highlighted that they often lacked enough data. This led to several problems, including:

- Inaccurate insights on how a campaign has performed

- No idea what the audience prefers

- Poor decision making

- Lack of personalization

Carl Walker, advertiser at 7Search PPC, says, ‘The previous ad network I used to advertise with wasn’t transparent about data at all. Inaccurate results were very frequent.’

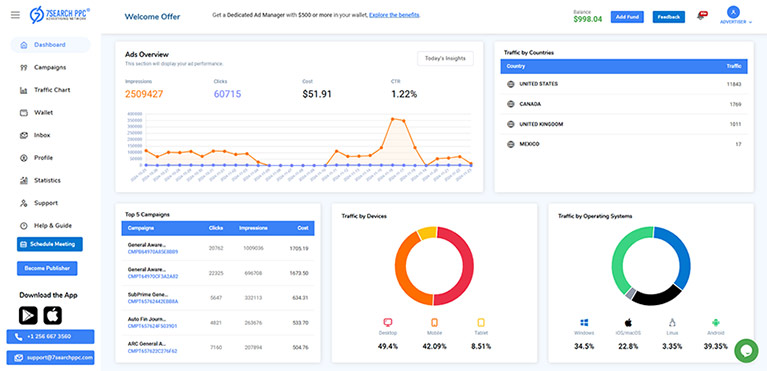

The Solution: Detailed Dashboard

7Search PPC’s dashboard provides accurate and detailed insights into a campaign’s performance. Advertisers can also check real-time statistics to keep up with their campaigns and track results accordingly.

5) The Challenge: Unfair bidding prices

Another complaint advertisers had was that most ad networks only worked on a single pricing model. Jason Moore, advertiser at 7Search PPC, says, ‘Previous ad platform I advertised through provided brand awareness campaigns at CPC prices.’

The Solution: Multiple pricing models

7Search PPC provides you CPC and CPM pricing models that you can choose as per your campaign’s objective. CPA is also currently under the works.

- In CPC (cost-per-click), you pay for every click your ad gets

- In CPM (cost-per-mille), you pay for every 1000 impressions of your ad

- In CPA (cost-per-action), you pay on the basis of a pre-specified action.

6) The Challenge: Where to target?

Despite the advanced targeting options, most advertisers struggle to identify their audience.

Lakita Elis, a travel agent advertising with 7Search PPC, says, ‘All the fancy tools out there just confuse me more. I have no idea where my audience is.’

The Solution: Ad Manager

To help with Lakita’s situation, we allotted her a personal ad manager. This ad manager guided her through the entire targeting process and suggested she target countries where people travel the most.

The ad manager provided her the following list by Data Pandas which helped her identify the most visited countries of all time.

(*Note: This ad manager is only allotted to advertisers who make a deposit of $500 or more. Advertisers can request an ad manager by looking for the option in the side navigation of your account)

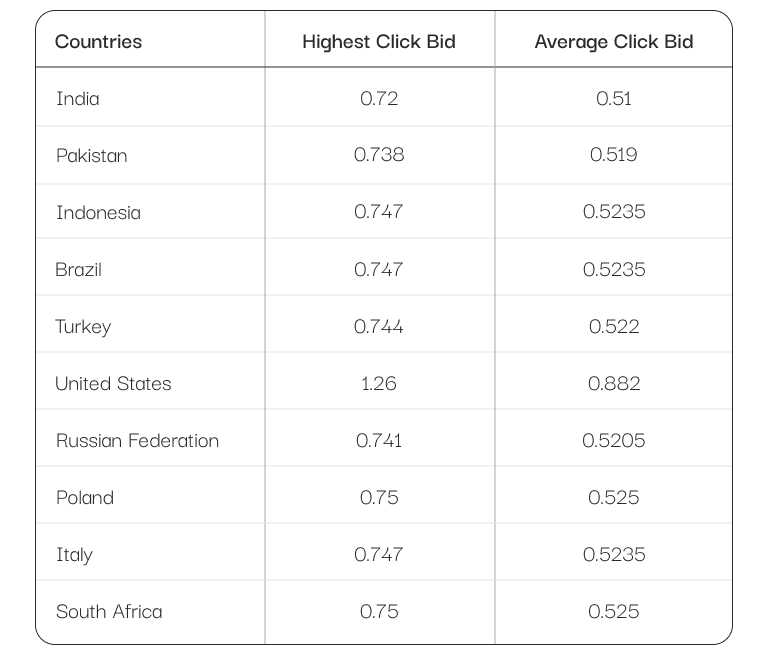

Click Bids You Can Expect From 7Search PPC

One of the most important aspects all advertisers consider before joining an ad network is the number of clicks they can expect through it.

Clicks are a direct and clear indicator that your travel ads are reaching the right audience. They further pinpoint how well your ads are performing and whether audiences are finding them appealing enough to take action. Clicks lead traffic to your website.

We understand your predicament. Which is why, after thorough analysis, we have gathered data to exhibit the highest and average estimated click bids across all verticals in 7Search PPC.

(*Note: All these click bids are estimated and are subject to change due to various factors, such as fluctuations in the travel demand, competition, and other market trends.)

We can proudly say that we hold the record for some of the most competitive bids across all verticals. Our bidding system is fair and impartial, and even small and mid-sized businesses can conveniently advertise on premium websites.

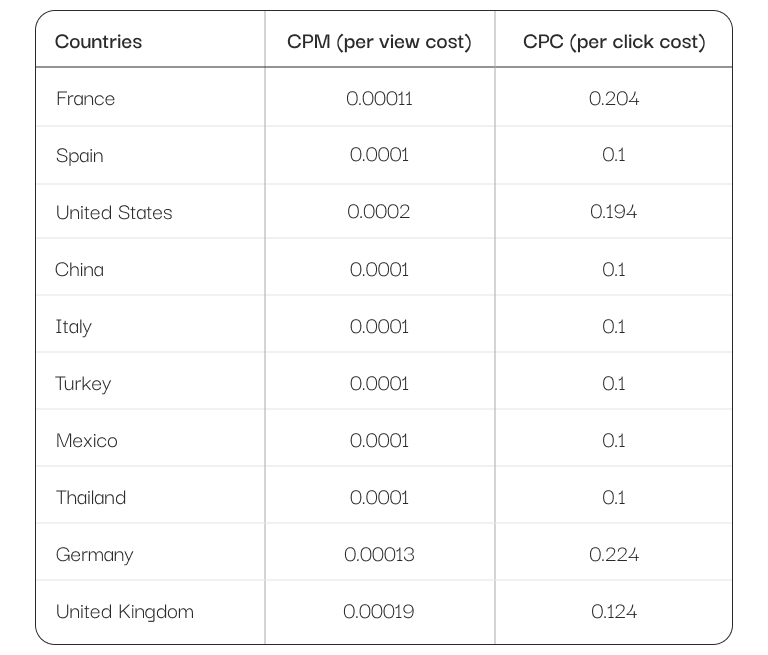

Country-Wise Minimum Bid Amount for the Travel Industry

Travel businesses always require flexibility in their advertising campaigns. Their ever-changing nature, which results from uncertainties in socioeconomic, environmental, and other factors, severely impacts their advertising.

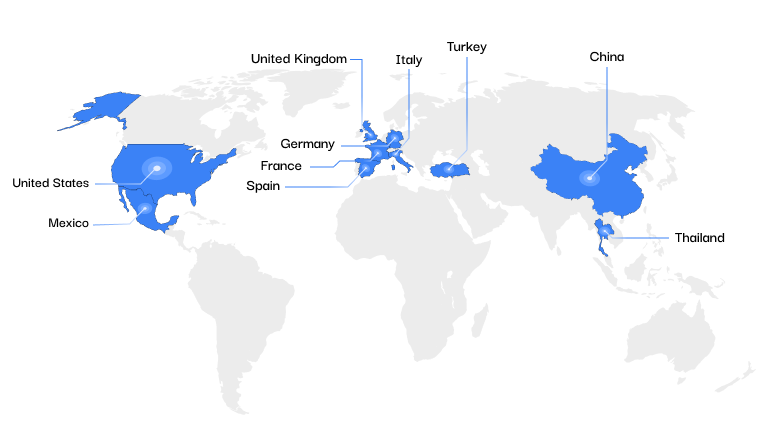

We identified that many travel advertisers find the best returns when they adjust their targeting to the changing environment. Many adopt the strategy of targeting countries that attract tourists throughout the year or during peak seasons.

Additionally, as travel businesses become localized, they seek to serve only a few countries.

At 7Search PPC, we provide effective country-wise targeting based on CPM (cost per mille) and CPC (cost-per-click) bidding models. Take a look at the minimum bid amounts that we offer to the travel and hospitality vertical.

(*Note: The minimum CPM and CPC bids are subject to change with the changing travel demand and competition.)

With the above data, we get a clear indication of how minimal the bidding prices at 7Search PPC are. Each differs greatly based on the country you target with your travel ads.

The minimum CPM bid in the United States can go up to 0.0002. Meanwhile, for CPC, the minimal bid can go up to 0.224 in Germany.

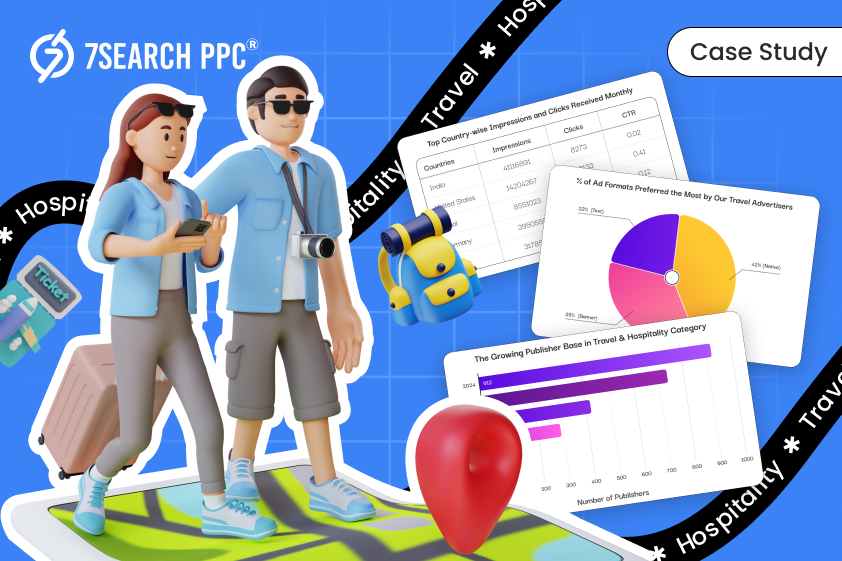

Expansion of Publisher Base in Travel Vertical Over The Years

It’s no secret that the real power of an advertising network lies in the quality of publisher inventory it holds.

Take a look at how our publisher base has witnessed significant growth over the years.

(*Note: The publishers’ data was gathered in the middle of December 2024, which could change by the end of the year. The numbers are bound to increase over the years.)

As you can see, the number of publishers who joined our platform has only increased over the years. What was once a mere 32 has now become 912. Overall, we have acquired 2,510 travel publishers so far.

Our publishers are spread across multiple GEOs to ensure maximum reach and exposure for your travel ads.

Moreover, we follow a thorough verification process before approving any publisher to join our network. With updated technology and algorithms, we filter out publishers with low-quality traffic, making sure that our advertisers get only the best.

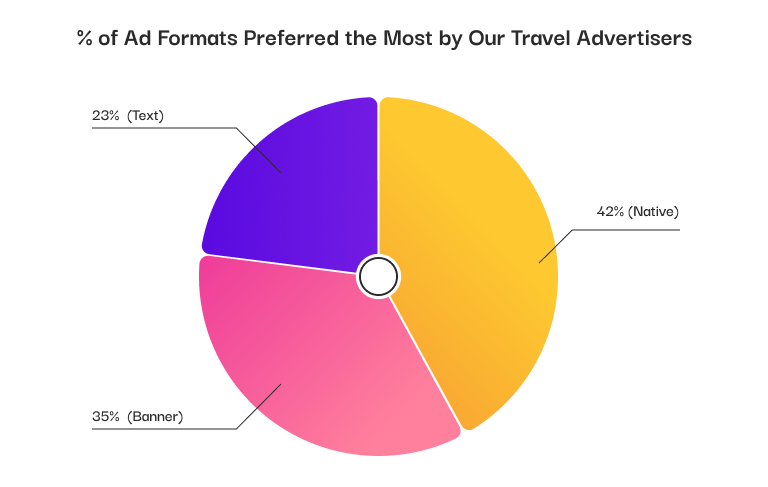

% of Ad Formats Preferred the Most by Our Travel Advertisers

Knowing what kind of ad formats advertisers prefer the most gives us insights into what the advertiser’s demand is, what needs improvement, and upgrade accordingly.

42% of our advertisers say they’ve seen significant returns from native ads. Percy Dill, advertiser at 7Search PPC, says, ‘Personally, I don’t like my time on the internet being intruded by ads. This is why I opted for native ads, thinking that maybe my audience shares the same mentality. And I was right!’

35% of them vouch for banner ads. Ms. Roselyn Smith, advertiser at 7Search PPC, says, ‘Banner ads allow me to show exactly the kind of experience someone can expect from my service.’

23% of them showed their satisfaction with text ads. R. Palmer, advertiser at 7Search PPC, says, ‘My budget was limited, so I opted for text ads. Many people warned me against it, but I found just the strategy!’

As you can see, the winning travel ad formats on our ad network are:

- Native Ads

- Banner Ads

- Text Ads

However, if you have a strategy with another ad format in mind, we can confidently cover that, too. Our popunder ads and in-page push ads are equally effective. Our video ad formats are also underway, and you will soon be able to leverage them, too.

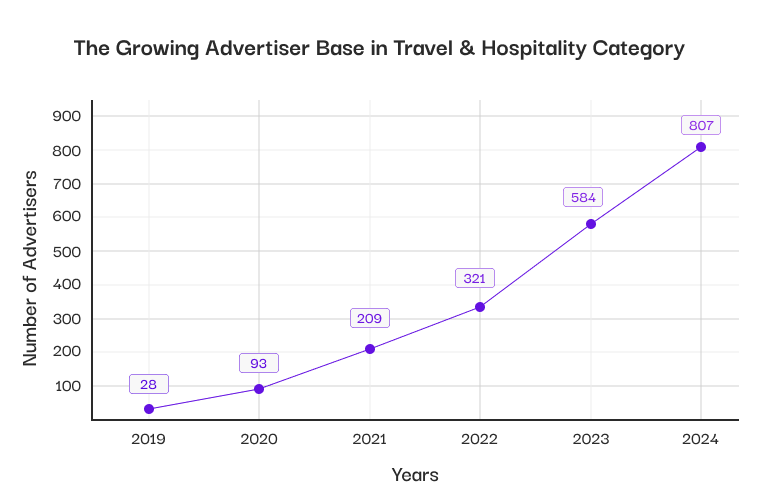

Growth of Travel Advertisers Over The Years

Ever since we first launched ourselves into the advertising world in 2019, our focus has been on helping more and more travel advertisers in their journey. We began with 26 advertisers putting their trust in us in our first year. As a new advertising network back then, we knew we had to give our best to make them stay. To uphold their trust, we continuously strived to deliver targeted campaigns and quality traffic with the minimal publishers we had.

In the next few years, we saw a steady rise in the number of advertisers joining us, with the number reaching 807 in December 2024. Overall, we now hold a total of 2,024 advertisers.

Throughout the years, we have regularly made efforts to understand our travel advertisers’ needs. Our focus is on providing them with high-quality traffic, advanced features, competitive bids, and complete transparency. We continuously upgrade our platform’s features to stay on top of trends.

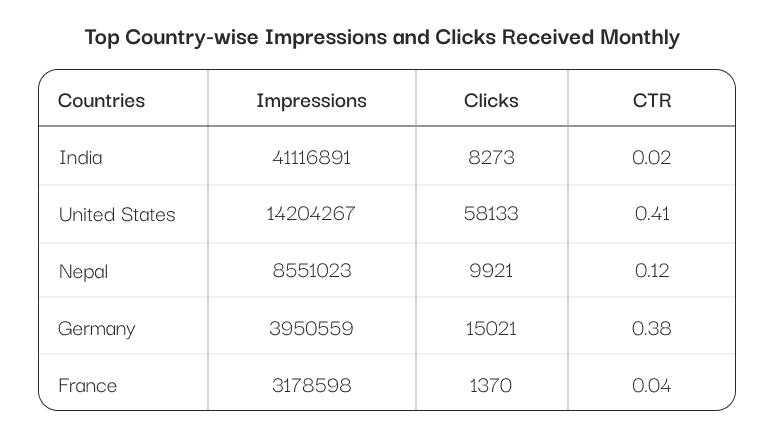

Top Country-Wise Impressions and Clicks Received Monthly

We understand that you’re eager to know what you can expect from 7Search PPC. Will your travel ads receive a good amount of impressions and clicks as you expect? Are we even worth investing in?

To answer your questions, we have compiled a list of overall impressions and clicks our active travel advertiser received on their campaigns in a span of one month.

As you can make out from the above data, advertisers receive the most impressions from countries like India, the United States, and Nepal. Clicks have a whole different story as most of them majorly come from the United States and Germany, followed by Nepal.

As you can make out from the above data, advertisers receive the most impressions from countries like India, the United States, and Nepal. Clicks have a whole different story as most of them majorly come from the United States and Germany, followed by Nepal.

In an industry like travel, it is essential to find audiences in countries that engage positively with travel ads. This gives you a general idea of where your business has the potential to thrive and yield the best results.

We suggest all our travel advertisers who are unsure about their targeting to try out targeting countries we see the most reciprocation from.

However, if you already have other target countries in mind, then also you can expect a great deal of impressions and clicks from our platform. The success of your travel ad campaigns is driven by the targeting and relevancy of your ads equally.

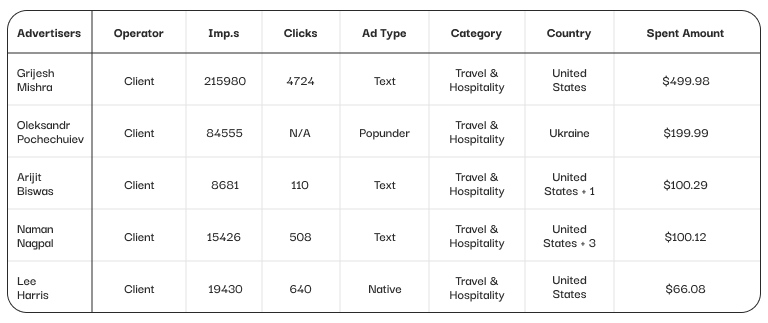

Our Top-Performing Travel Ad Campaigns of 2024

The year 2024 has been a phenomenal year for all our travel advertisers. Even with minimal spending, most were able to achieve a good number of impressions and clicks on their travel ads.

Most of our clients expressed satisfaction with the results, so we decided to analyze all of them to find the top-performing ones.

From the above data, it is clear that you can achieve great returns with minimal spending on your campaigns with us. Mr. Grijesh Mishra, our top advertiser, was able to achieve a solid 215,980 impressions and 4724 clicks with a $499.98 spend. Our runner-up, Mr. Oleksandr Pochechuiev, took a slightly different route and opted for popunder ads. He managed to rack up a solid 84,555 impressions from them.

As we keep expanding our publisher base, these numbers are only going to grow.

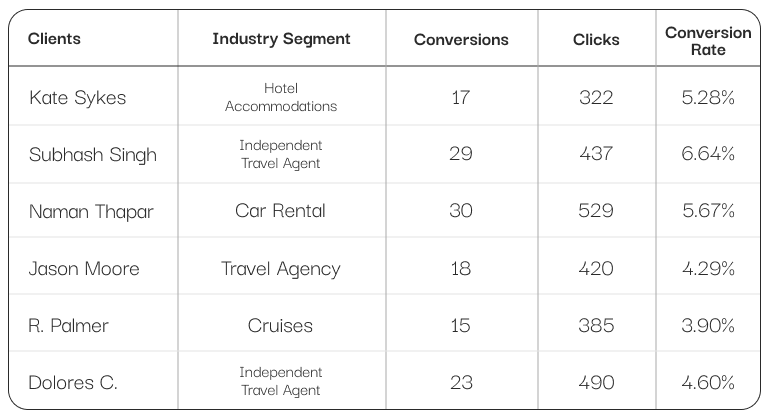

Average Estimated Conversion Rate Expected with 7Search PPC

We all know that conversion rates determine the real value and measure how well ad campaigns have performed. Successful bookings, contact form sign-ups, newsletter subscriptions, free trials and demos, etc., are extremely crucial metrics that travel advertisers watch out for.

So, to get a rough estimate of the conversion rates our advertisers come across, we decided to get in touch with them. We emailed 25 of them regarding their campaign results, including the number of conversions and total clicks their travel ads received in the span of the previous 2 months. Out of the 25 advertisers, 20 of them reverted back with their responses. Out of them, 6 provided us with sufficient data to move forward with this.

To calculate the conversion rate, we have decided to use the formula:

Conversion Rate = Conversions Received / Clicks Received * 100

We can further calculate the average conversion rate using the formula:

Average Conversion Rate = Total Conversion Rate of All Advertisers/Total Number of Advertisers

= (5.28 + 6.64 + 5.67 + 4.29 + 3.90 + 4.60) / 6

= 30.38 / 6

= 5.06%

As you can see from the above data, the conversion rates achieved by our advertisers usually range between 3% to 7%, which is considerably remarkable considering that the industry standard is notably 2% to 8%.

(*Note: These numbers are just a rough estimate of what conversion rates advertisers can expect when they start advertising with us and are bound to change.

As an ad network, determining conversion rates is a bit tricky for us. Customers could be visiting the advertiser’s landing page either through paid travel ad campaigns, or via other promotional channels.)

Final Outcomes

- After the severe drop in the travel industry during the pandemic, the industry is back to normal and has been booming in recent years.

- Travel advertisers are back on their feet, with travel advertising spending expected to reach 7.24 billion in 2024.

- With the abrupt hike in the industry, advertisers struggle to cope and compete with the competition.

- Because of its inherent nature, targeting is a crucial aspect when it comes to travel advertising.

- 7Search PPC stands out as an exemplary travel advertising network with advanced targeting features, a handy interface, and a foolproof analytics system.

- 7Search PPC offers minimal bid amounts, which enables businesses of all sizes to advertise conveniently.

- Advertisers at 7Search PPC prefer native, banner, and text ad formats the most. However, popunder and in-page push ads have given equally impressive results.

- 7Search PPC regularly gets in touch with its advertisers to review their challenges and expectations and works on them to provide desired results.

Ending Note

As travelers take up new routes to explore, travel businesses are going to follow with their advertising. From targeting a local area to a whole country, you need to be present where the potential customers are. This vertical is set to experience exponential growth, and along with it comes competitiveness.

7Search PPC is here to support you through this wild ride of finding customers for your business. We understand your fears and hopes and are constantly making efforts to improve our platform and help you put your best foot forward.